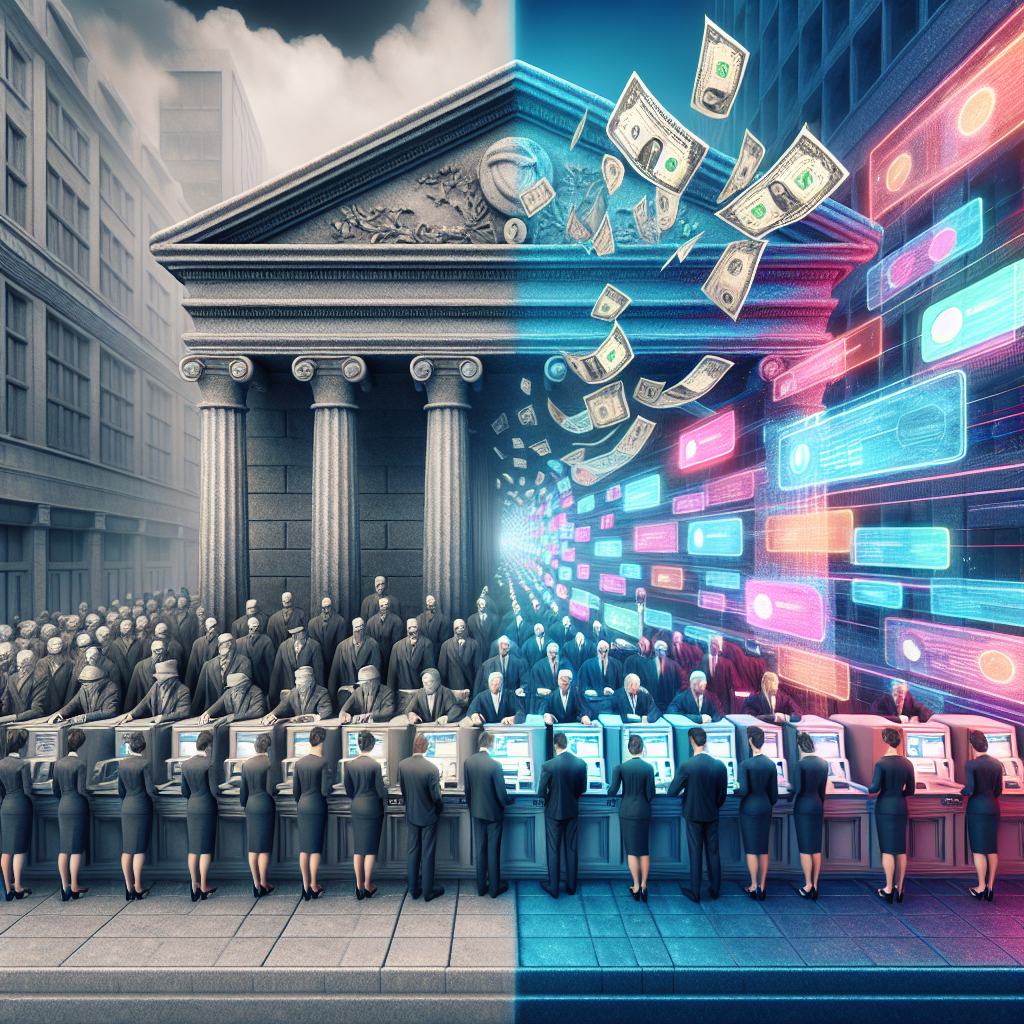

In today's fast-paced world, the way we handle our finances is undergoing a digital revolution. One of the most significant advancements in this realm is the rise of mobile payment technology, which is revolutionizing the traditional banking landscape. Mobile payments offer convenience, efficiency, and security, making them increasingly popular among consumers and businesses alike. This blog post delves into the impact of mobile payment technology on the banking industry, exploring the transformative effects and the future implications of this ever-evolving trend.

The Evolution of Mobile Payments

Mobile payment technology has come a long way since its inception. From the early days of simple SMS-based transactions to the sophisticated mobile wallets and contactless payment methods available today, the evolution has been remarkable. Consumers now have the ability to make seamless, instant payments using their smartphones, eliminating the need for physical cash or cards. This convenience has fueled the widespread adoption of mobile payments, with more and more people opting for the ease and simplicity it offers.

Transforming Customer Experience

One of the key impacts of mobile payment technology on the banking industry is the transformation of the customer experience. With mobile payments, customers can conduct transactions anytime, anywhere, with just a few taps on their phone. This level of accessibility has redefined the way people interact with their finances, making banking more convenient and personalized. Moreover, features like real-time notifications and personalized offers enhance the overall customer satisfaction and engagement, fostering stronger relationships between banks and their clients.

Security and Trust

Despite the convenience and speed of mobile payments, security remains a top priority for both consumers and financial institutions. The implementation of robust security measures, such as biometric authentication and tokenization, has significantly strengthened the security of mobile transactions. Additionally, the use of encryption technologies ensures that sensitive data is protected from cyber threats. As a result, mobile payment technology has instilled trust among users, leading to increased adoption rates and a shift towards a cashless society.

Reshaping the Banking Landscape

The proliferation of mobile payment technology is reshaping the banking landscape in profound ways. Traditional brick-and-mortar branches are gradually being replaced by digital channels, with banks investing heavily in mobile banking apps and online platforms to meet evolving customer preferences. The ability to offer seamless, integrated payment solutions has become a competitive advantage for financial institutions, driving innovation and pushing the boundaries of traditional banking services.

Future Trends and Opportunities

Looking ahead, the future of banking lies in the continued evolution of mobile payment technology. As advancements in artificial intelligence, machine learning, and blockchain reshape the financial landscape, banks will need to adapt to stay competitive. Mobile payments will play a central role in this transformation, offering new opportunities for personalization, financial inclusion, and seamless cross-border transactions. By embracing these innovations and staying ahead of the curve, banks can position themselves as industry leaders in the digital era.

Conclusion

In conclusion, mobile payment technology is revolutionizing the banking industry, driving a shift towards digital-first banking experiences. The convenience, security, and customer-centric nature of mobile payments are reshaping the way we manage our finances, creating new opportunities for both consumers and businesses. As technology continues to evolve, banks must stay agile and innovative to meet the changing needs of their customers. By embracing mobile payment technology and leveraging its full potential, banks can navigate the complexities of the digital age and shape the future of banking for generations to come.

Comentários